STOCADVISORY

TRANSACTION ADVISORY | GROWTH ENABLEMENT | CORPORATE DEVELOPMENT | CFO ADVISORY

STOC Advisory is a specialist transaction and growth enablement firm serving healthcare-focused PE firms executing multi-platform buy-and-build strategies. As a platform-literate, operator-aware partner, we combine AI-driven research, accelerated diligence, and hands-on operational support to improve speed, confidence, and scalability across healthcare deals.

BPOC's portfolio spans 16 active platforms across Providers, Outsourced Services, Products & Distribution, and Pharmacy & Pharma Services. STOC's integrated services—Transaction Advisory (TAS), Corporate Development Support (CDS), Growth Enablement (GES), and CFO Advisory—provide healthcare-specific intelligence and repeatable frameworks designed for pure-play healthcare buy-and-build execution.

DEAL ENABLEMENT

AI-accelerated diligence and healthcare-specific sourcing

GROWTH SUPPORT

Post-close KPI tracking and operational enablement

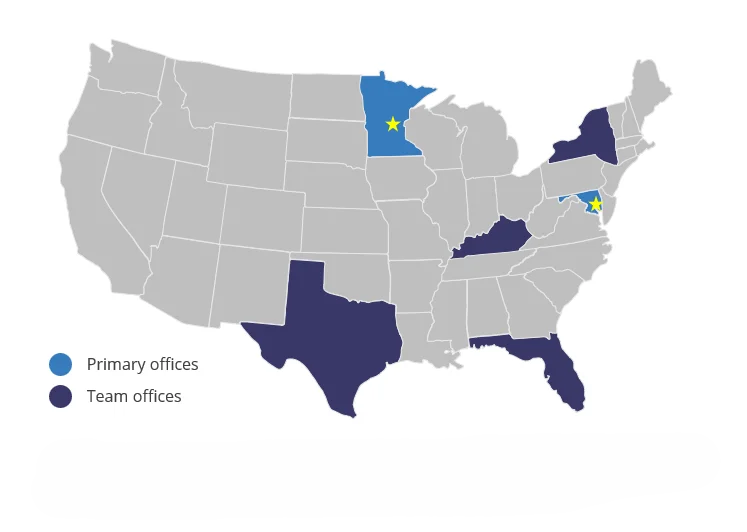

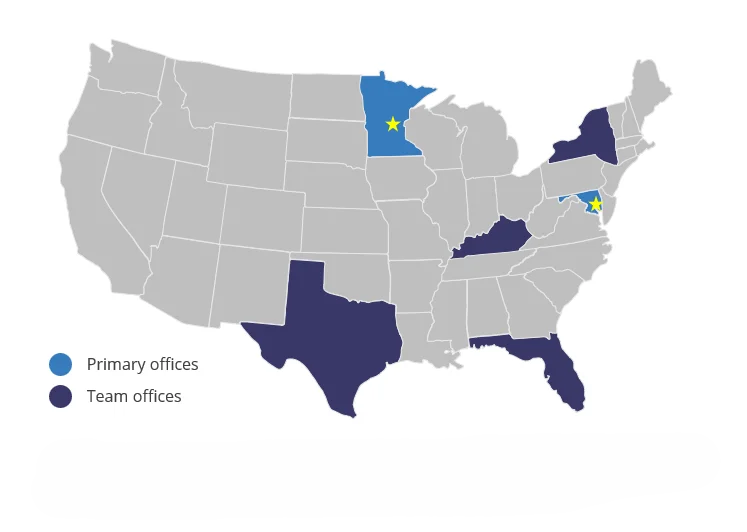

Global team of 30+ professionals throughout the country with primary offices in Baltimore, MD and Edina, MN. Additional personnel is located remotely throughout the country.

200+

Transactions Across

All Sectors

75+

Healthcare Portfolio

Companies

AI-Driven

Healthcare Data

Intelligence

3-4 Weeks

Accelerated QoE

Turnaround

1

Healthcare Market Intelligence

Web scraping and AI-powered data enrichment identify healthcare targets before traditional intermediaries. External validation of payor mix, referral networks, and competitive positioning across healthcare sectors.

2

AI-Accelerated Diligence

Machine learning automation for EBITDA normalization, working capital trending, and revenue quality assessment specific to healthcare reimbursement models—reducing diligence timelines from 6-8 weeks to 3-4 weeks.

3

Healthcare Platform Expertise

Deep understanding of provider networks, outsourced services scalability, product distribution channels, and pharmacy/pharma services complexity. We speak the language of healthcare operators and understand regulatory nuances.

4

Sector-Specific Experience

75+ healthcare transactions across Providers (PT, dental, primary care), Outsourced Services (staffing, benefits), Products & Distribution (DME, med-tech), and Pharmacy & Pharma Services (clinical research, packaging).

5

Repeatable Methodology

Standardized screening criteria, healthcare-specific diligence templates, and integration frameworks enable consistent execution across multiple platforms and simultaneous add-on acquisitions.

6

Regulatory & Compliance Focus

Assessment of HIPAA compliance, payor contracting, clinical quality metrics, and healthcare regulatory risks—not just financial metrics but operational sustainability for healthcare platform strategies.

42

Platform Companies

Supported

128

Add-On Transactions

Completed

89%

Repeat Engagement

Rate (Tier 1)

18

Active PE Fund

Relationships

3.8 Weeks

Average QoE

Delivery Time

$15-150M

Typical Deal

Value Range

STOCADVISORY

TRANSACTION ADVISORY | GROWTH ENABLEMENT | CORPORATE DEVELOPMENT | CFO ADVISORY

Our integrated service platform supports healthcare-focused PE firms from deal sourcing through post-close value creation. Transaction Advisory Services (TAS) and Corporate Development Support (CDS) enable accelerated deal execution, while Growth Enablement Services (GES) and CFO Advisory drive operational performance. All services leverage healthcare-specific intelligence and standardized processes designed for pure-play healthcare portfolios.

Driving Repeatable Deal Flow Influence in Healthcare

STOC's marketing and content function exists to drive repeatable deal flow influence, not brand awareness in isolation. We position ourselves as a specialist transaction and growth enablement firm—a platform-literate, operator-aware partner with deep healthcare expertise that improves speed, confidence, and scalability across deals.

Our marketing supports: BD conversations with healthcare PE sponsors and operators | Credibility reinforcement with healthcare investment bankers | Cross-sell and service expansion opportunities | Pipeline influence measurement and optimization

🎯

FIT

Strategic alignment with healthcare platform thesis

📊

FINANCIALS

Rigorous QoE and healthcare-specific assessment

📈

OPPORTUNITY

Growth potential and synergy capture

Quality of Earnings | Working Capital | Revenue Assessment

Buy-side financial diligence combining machine learning automation with healthcare sector expertise.

- AI-accelerated EBITDA normalization and trend detection

- Healthcare-specific revenue quality assessment and payor analysis

- External data corroboration of clinical volumes and market position

- Working capital trending and target NWC calculation

- Regulatory compliance and reimbursement risk assessment

- 3-4 week turnaround for lower middle market healthcare deals

Market Mapping | Target Identification | Pipeline Management

Scalable deal sourcing in healthcare using proprietary research and CRM-integrated workflows.

- Healthcare-specific proprietary research and target identification

- External data validation of clinical volumes and network positioning

- Sub-sector pipeline development (providers, outsourced, pharma)

- CRM integration provides real-time visibility into deal flow

- Pre-LOI coordination and preliminary diligence support

- Repeatable methodology across healthcare platform strategies

KPI Tracking | Performance Dashboards | Operational Support

Post-close support to accelerate value creation and healthcare platform performance.

- Real-time healthcare KPI tracking and performance dashboards

- Clinical volume growth and referral network development

- Operational efficiency improvement initiatives

- Integration planning and execution support

- AI-driven workflow automation and process optimization

- Hands-on enablement with healthcare operator perspective

Financial Leadership | Operations Optimization | Value Maximization

Strategic financial support for healthcare portfolio companies at critical inflection points.

- Interim and fractional CFO services for healthcare companies

- Healthcare-specific financial systems and reporting

- Budgeting, forecasting, and scenario modeling

- Payor contracting and reimbursement optimization

- M&A integration and healthcare carve-out support

- Board-ready financial reporting and analysis

Providers

Physical therapy, orthodontics, dental practices, primary care networks, and specialty provider groups

Outsourced Services

Healthcare staffing, benefit technologies, consulting services, and revenue cycle management

Products & Distribution

DME distribution, medical products engineering, and healthcare equipment manufacturing

Pharmacy & Pharma Services

Clinical research, pharmacy networks, pharmaceutical packaging, and specialty pharmacy services

BPOC Portfolio Context: Alliance Physical Therapy Partners, Atlas Clinical Research, Bond Orthodontic Partners, Bridgeway Benefit Technologies, ClareMedica Health Partners, D4C Dental Brands, Health Management Associates, Home Care Delivered, Medical Solutions, Medicus Healthcare Solutions, Midwest Products and Engineering, Network Partners Group, Praxis Packaging Solutions, Southeast Primary Care Partners, VytlOne (fka Maxor National Pharmacy), and Zenith American Solutions. With 25+ years of pure-play healthcare investing experience and $2.2B in capital commitments across 6 funds, BPOC represents one of the longest-tenured healthcare PE firms. STOC's healthcare sector expertise and repeatable methodology enable simultaneous support across BPOC's portfolio while maintaining deep knowledge of regulatory nuances, payor dynamics, and clinical operations.